Samesurf Cobrowsing Creates “White-Glove” Service in Financial Onboarding

October 27, 2025

Samesurf is the inventor of modern co-browsing and a pioneer in the development of core systems for Agentic AI.

Digital onboarding remains a critical bottleneck for financial institutions and Fintech providers, which represents a major failure point in customer acquisition. Despite significant investment in digital transformation, current processes are often flawed, with high abandonment rates. Many potential clients who begin a digital application fail to complete it thereby leaving high-intent customers turning away due to friction at the point of conversion.

The impact of this friction is direct and measurable, as it results in lost revenue and wasted customer acquisition costs. Abandonment is particularly damaging for high-value transactions such as online loan applications. This persistent challenge underscores the urgent need for institutions to rethink the design of their digital onboarding systems to remain competitive in today’s fast-paced digital environment.

Analysis of user behavior during digital abandonment shows that impatience is a key driver, especially among younger, digitally-native consumers. While traditional explanations cite long or complicated processes, the highest dropout occurs among users expecting speed and effortless interaction. When friction arises, this audience abandons immediately. Samesurf Cobrowsing addresses this challenge by providing real-time, guided support that helps customers complete applications without delay. By offering instant intervention and continuous guidance, Samesurf Cobrowsing transforms digital onboarding from a friction-filled process into a seamless, high-conversion experience.

Introducing the Compliant White-Glove Digital Model

The traditional concept of white-glove service in financial services refers to a high-touch, hand-held process where a dedicated representative guides a customer in real time. Historically, this VIP treatment has been reserved for high-profile clients or complex products, such as wealth management or retirement enrollment, where intensive, resource-heavy support is required.

Samesurf Cobrowsing transforms this model by bringing personalized, high-touch guidance directly into the digital environment. By allowing a representative to join a customer’s browser session instantly, Samesurf Cobrowsing removes the need for channel switching or in-person meetings. Unlike purely self-service platforms, the technology embeds expert support into the workflow itself and ensures customers receive immediate assistance without losing progress or context. This approach scales the traditionally resource-intensive white-glove model into a digital standard, ultimately reducing Average Handle Time for complex tasks and enabling institutions to offer premium guidance across all customer segments. Samesurf Cobrowsing democratizes expert support and improves completion rates while enhancing the competitive profile of the institution.

Navigating Complexity and Data Sensitivity with Samesurf Cobrowsing

Core financial workflows, such as new account creation, complex loan origination, or retirement enrollment, are inherently complex and prone to digital friction. Applications often require detailed data entry, document uploads for compliance, and acceptance of extensive legal disclaimers. The sheer number of fields and steps can overwhelm customers, drive abandonment, and force reliance on unqualified external guidance, which slows progress and risks privacy. Samesurf Cobrowsing injects authorized, expert support directly into these workflows, which ensures customers can complete transactions efficiently while maintaining confidence and accuracy.

A non-negotiable requirement in digital onboarding is the protection of sensitive data, including personally identifiable information and cardholder data. Financial applications require customers to enter highly confidential information, from Social Security Numbers to financial account details. Generic screen-sharing solutions are insufficient because they expose the customer’s entire desktop, including notifications, files, and other open tabs, violating privacy and regulatory mandates. Samesurf Cobrowsing addresses this by confining agent visibility strictly to the transaction window, thus enforcing in-page security protocols and eliminating exposure of unrelated sensitive information.

By integrating focused, encrypted, and compliant visual engagement into the application path, Samesurf Cobrowsing not only enhances customer support but also strengthens organizational security and IT governance. The technology ensures that financial institutions can simplify oversight, minimize compliance risks, and maintain full control over sensitive workflows, all while delivering the responsive, guided experience that modern customers demand.

Secure PII Handling via Element Redaction with Samesurf Cobrowsing

Providing high-touch financial service digitally requires guiding customers through applications without exposing or transferring sensitive data. Samesurf Cobrowsing meets this need with enterprise-grade Element Redaction, which keeps all sensitive information securely on the customer’s device while allowing agents to provide real-time guidance.

Samesurf Cobrowsing is built for compliance by design, with robust encryption protocols protecting every session and eliminating the need for proxies or data transfer. Session recordings capture only the redacted agent view, enforcing compliance in real time. Dynamic Element Redaction masks sensitive inputs like Social Security Numbers, credit card details, and passwords, while agents still see the form structure needed for accurate guidance.

This technology helps financial institutions satisfy key privacy standards. PCI-DSS is enforced by limiting agent access to only necessary data, GDPR compliance is supported with explicit consent and data minimization, and HIPAA principles are respected where financial and health data overlap. By combining security, compliance, and usability, Samesurf Cobrowsing enables institutions to deliver secure, high-touch digital experiences at scale.

The Power of In-Page Control Passing with Samesurf Cobrowsing

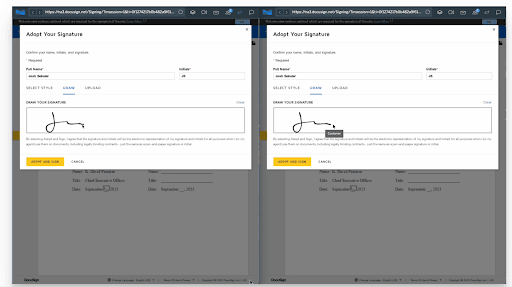

Samesurf Cobrowsing moves beyond passive viewing to true real-time collaboration through features like In-Page Control Passing, designed to reduce friction and boost form completion rates.

Unlike traditional screen sharing, Samesurf Cobrowsing requires no downloads or installations, starting instantly with a single click. By sharing the underlying web content rather than a static video feed, sessions remain fully synchronized and securely confined to a single webpage or app.

In-Page Control Passing allows both agent and customer to interact seamlessly, clicking, scrolling, typing, and to switch control instantly. Agents can guide customers through complex sections, annotate fields, and pre-fill non-sensitive data, which helps to reduce cognitive load and ensure applicants focus only on unique, essential information. This prevents errors, minimizes frustration, and directly combats high abandonment rates in multi-step forms.

Control switches back automatically for sensitive fields like SSNs or passwords, keeping customers in charge of their private data while still benefiting from guided support. By combining security, seamless interaction, and expert guidance, Samesurf Cobrowsing transforms digital onboarding into a frictionless, high-conversion experience.

Governance and Audit for Compliance Officers

Samesurf Cobrowsing delivers robust governance and audit capabilities that ensure security and accountability across every session. Comprehensive session logging tracks all user actions, page views, timestamps, and interactions, providing a complete, auditable record.

Element Redaction remains active during recordings, so only the scrubbed agent view is captured. Sensitive PII never leaves the customer’s device thereby guaranteeing that audit trails are compliant by design and easing a primary concern for compliance officers.

The platform also functions as a structured IT General Control. Role-Based Access Controls ensure agents see only what their role allows, supporting least-privilege security principles. Enterprise-grade certifications, including ISO 27001, SOC 2 Type II, and PCI DSS Level 1 compliance, reinforce trust and minimize institutional risk.

By combining secure, compliant visibility with pre-built governance features, Samesurf Cobrowsing enables compliance officers to confidently integrate visual engagement into regulated financial workflows.

Secure Engagement with Samesurf Cobrowsing

Financial institutions face the dual challenge of high digital application abandonment and strict data security mandates, including PCI-DSS, GDPR, and HIPAA principles. Samesurf Cobrowsing addresses both by combining enterprise-grade Element Redaction with collaborative In-Page Control Passing. The platform ensures sensitive information remains visible only on a strict “Business Need to Know” basis while simultaneously guiding customers through complex workflows.

This secure visual engagement is no longer just a customer service enhancement; it is critical infrastructure. Samesurf Cobrowsing transforms high-risk, high-friction onboarding into a scalable, efficient, and compliant “white-glove” experience. By stabilizing conversion rates, reducing operational costs through faster interactions, and strengthening regulatory compliance, Samesurf Cobrowsing becomes a decisive competitive advantage for financial institutions navigating the digital economy.

Visit samesurf.com to learn more or go to https://www.samesurf.com/request-demo to request a demo today.