Samesurf Co-Browsing for Faster, Smarter Insurance Claims

September 16, 2025

Samesurf invented modern co-browsing.

The insurance claims process is often complicated and stressful, filled with paperwork, phone calls, and repeated explanations. For policyholders, it can feel overwhelming, and for insurance companies, it’s time-consuming, costly, and prone to errors. Traditional methods relying on verbal descriptions or static document uploads are no longer enough. Samesurf Co-browsing changes the game by enabling real-time visual collaboration, turning the claims process into a smoother, more empathetic, and efficient experience for everyone.

By shifting from reactive, text-based interactions to proactive, visual co-browsing, Samesurf not only speeds up claims but also builds trust and confidence when customers need it most.

The Claims Process Problem and How Co-Browsing Solves It

Filing an insurance claim is stressful enough without navigating confusing portals, endless forms, and strict document requirements. When a policyholder reaches out for help, verbal explanations often fall short. Questions like “Can you see the field for your claim number?” or “Can you upload a photo of the damage?” can leave customers frustrated and confused, slowing down the process.

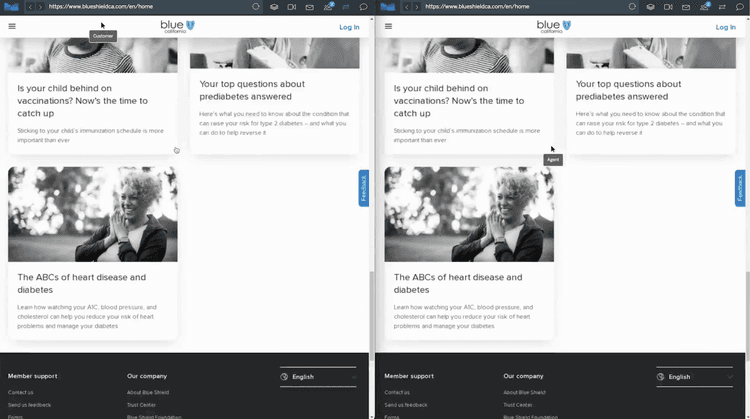

These communication gaps result in delayed claims, higher operating costs, more errors, and unhappy customers. Samesurf Co-browsing solves this by giving agents a real-time, shared visual space. With just one click, the agent can see exactly what the policyholder sees, guide them step-by-step, highlight fields, and even take control (with permission) to ensure documents are submitted correctly. Co-browsing turns a frustrating, error-prone process into a smooth, collaborative experience.

From Reactive Support to Proactive Guidance with Co-Browsing

The real value of Samesurf Co-browsing in the claims process is not just solving problems but preventing them. Insurance providers can embed co-browsing directly into their online claims portal. If a policyholder spends too long on a section or appears confused, a prompt can offer a live, human-assisted co-browsing session. This proactive support gives customers the help they need exactly when they need it, reducing frustration and preventing abandoned claims.

Agents can also use co-browsing to guide policyholders through the entire claims process from start to finish. They can ensure all fields are filled out correctly and all required documents are uploaded in the right format. This hands-on approach decreases errors and incomplete submissions, saving time for both the company and the policyholder. Co-browsing transforms the agent’s role from a reactive troubleshooter into a proactive claims guide.

The Role of Agentic AI in Claims Processing with Co-Browsing

Agentic AI is increasingly used to automate parts of the claims process, from collecting initial data to detecting potential fraud. However, human support is still essential for complex or ambiguous claims. A chatbot can ask a policyholder for their policy number, but it cannot verify damage visually or guide them through tricky uploads.

Samesurf Cobrowse bridges this gap in the AI-human workflow. The agentic AI handles the initial claim intake and gathers basic information. If it detects a claim that requires visual verification or notices the policyholder struggling online, it can escalate the session to a human claims adjuster. The adjuster can then start a co-browsing session with full context from the AI interaction, visually reviewing the claim form and guiding the policyholder to input information correctly and upload supporting documents. This combination of AI efficiency and human-led co-browsing ensures accuracy, empathy, and a seamless customer experience.

Building Trust Through Empathy and Co-Browsing

After a loss, a policyholder’s experience with their insurance provider can shape their trust and loyalty. Samesurf Co-browsing makes the claims process transparent and collaborative, allowing the policyholder to see every action the agent takes. This visibility reduces anxiety and builds confidence in the process.

Agents can use the shared screen to guide the customer step by step, explaining how to check claim status, upload documents, or understand next steps. This visual clarity and hands-on support go beyond what a phone call can provide. By combining empathy with real-time co-browsing, insurance providers can turn a stressful situation into a positive, reassuring experience that strengthens long-term loyalty.

The Samesurf Advantage in Insurance Claims

In the insurance industry, security and compliance are critical. Any technology used in the claims process must be both reliable and safe. Samesurf Co-browsing meets these standards with its no-download, no-code design, keeping the policyholder’s device secure while protecting sensitive information. Built-in data redaction automatically hides fields like social security numbers and policy details from the agent, ensuring privacy without limiting collaboration.

The combination of strong security and simple, single-click co-browsing makes Samesurf a perfect fit for insurance providers. Agents can guide policyholders in real time, reducing errors and frustration while delivering a clear, empathetic experience. By turning a traditionally complex process into a seamless, visually guided journey, Samesurf co-browsing improves accuracy, reduces friction, and fosters trust, confidence, and loyalty even during stressful claims events.

Visit samesurf.com to learn more or go to https://www.samesurf.com/request-demo to request a demo today.