Banking Made Secure with Samesurf Cobrowse

August 28, 2025

Samesurf invented modern co-browsing.

For years, the financial services industry has grappled with a fundamental paradox: how to deliver the convenience of digital banking without sacrificing the security and human trust of an in-person visit. While online portals and mobile apps have made checking balances and transferring funds effortless, complex tasks, like applying for a loan, setting up a new account, or troubleshooting a payment issue, can still be fraught with anxiety and confusion. In these critical moments, customers crave the guidance of a trusted expert, but traditional support channels often fall short.

This is where Samesurf cobrowse emerges as a revolutionary solution, bridging the gap between digital convenience and personal security. Samesurf cobrowse, a patented, no-download technology, allows bank representatives to securely and interactively guide a customer through their online banking journey in real-time. It’s a tool that provides the clarity of an in-branch meeting with the ease of a digital session, all while upholding the highest standards of data privacy and security.

The Financial Services Dilemma: Digital Friction vs. Security

The modern banking customer expects a seamless digital experience. However, when faced with complex financial decisions or technical roadblocks, digital friction can quickly erode trust. Consider these common pain points:

- Complex Forms and Applications: Applying for a mortgage, a credit card, or a business loan online can be a daunting process. A single missed field or a misunderstanding of a term can lead to delays or application rejection. Without human guidance, many customers abandon these forms out of frustration.

- Troubleshooting Technical Issues: When a customer has trouble logging in, resetting a password, or finding a specific feature on their online portal, explaining the issue over the phone can be a frustrating game of “I see a button that says…” This lack of a shared visual reference prolongs support calls and increases customer frustration.

- Understanding Products and Services: Financial products are inherently complex. Explaining the nuances of a high-yield savings account versus a certificate of deposit, or the benefits of one credit card over another, is best done with a visual aid. A phone conversation simply can’t provide the level of clarity a customer needs to make an informed decision.

- Security Anxieties: Customers are right to be cautious about sharing personal financial information online. Traditional screen-sharing tools are a major concern because they can expose a customer’s entire desktop, including personal files and other sensitive information. This security risk has been a significant barrier to effective digital support in the financial sector.

- Building Trust from a Distance: For critical financial decisions, customers want to feel confident in the person assisting them. It’s difficult to build this rapport and trust through text chat or a disembodied voice on the phone.

These challenges lead to higher operational costs, longer customer service queues, and, most critically, a diminished customer experience that can lead to account attrition. The financial industry needs a tool that can humanize the digital experience without compromising security—and that tool is Samesurf cobrowse.

Samesurf Cobrowse: The Secure Path to Clarity

Samesurf cobrowse is designed from the ground up to address the unique needs of the banking and financial services sector. Its secure architecture and intuitive features empower agents to provide a new level of support, building trust and simplifying even the most complex tasks. Here’s how it works:

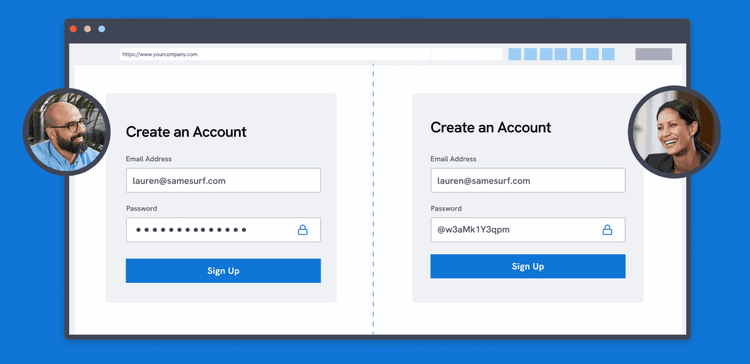

- Secure and Private Interactions: The cornerstone of Samesurf cobrowse is its commitment to privacy. Unlike traditional screen sharing that broadcasts the entire desktop, Samesurf cobrowse limits the session to the browser tab containing the bank’s website. Furthermore, Samesurf’s patented element redaction technology automatically masks sensitive data—like account numbers, credit card details, Social Security numbers, or login credentials—from the agent’s view. This feature ensures compliance with strict regulations like PCI DSS, HIPAA, and GDPR, giving both the bank and the customer complete peace of mind.

- Guided Form Completion: A bank representative can initiate a cobrowse session to help a customer navigate a loan application. The agent can use their cursor to point out required fields, explain confusing terms, and even fill in information on the customer’s behalf (with explicit permission), ensuring the form is completed accurately and efficiently. This direct guidance drastically reduces errors and application abandonment rates.

- Real-Time Product Consultation: When a customer is considering a new account or a complex investment product, a representative can use Samesurf cobrowse to show them the different options side-by-side. They can highlight key features, explain interest rates, and demonstrate how to use online calculators, providing a clear and visual comparison that is far more effective than a verbal explanation.

- Effortless Troubleshooting: When a customer reports an issue, the agent can launch a Samesurf cobrowse session to see the exact problem in real-time. Whether it’s an error message, a login glitch, or an inability to find a specific transaction, the agent can immediately diagnose the problem and guide the customer to a resolution. This visual approach eliminates frustration and significantly reduces average handling time.

- Seamless Onboarding: For new customers, Samesurf cobrowse can be used to provide a personalized, step-by-step tour of the online banking portal. Agents can show them how to set up alerts, manage their budget, or use the mobile app, making the onboarding process feel simple and empowering.

- Building Trust and Relationships: Samesurf cobrowse provides a personal, human touch to the digital experience. By actively collaborating with the customer in a secure environment, agents build rapport and demonstrate a commitment to service. This personal interaction strengthens the customer relationship and fosters long-term loyalty.

The Samesurf Cobrowse Advantage for Financial Institutions

Beyond improving the customer experience, implementing Samesurf cobrowse offers significant business benefits:

- Increased Conversion Rates: Simplifying complex applications and providing immediate support leads to a higher rate of completed applications and new account openings.

- Reduced Support Costs: Faster resolution times and higher first-call resolution rates translate to a more efficient call center and lower operational costs.

- Enhanced Compliance and Security: The platform’s privacy-first design ensures that all digital interactions meet the stringent security and compliance requirements of the financial industry.

- Higher Customer Satisfaction and Retention: A secure, intuitive, and personal experience leads to higher customer satisfaction scores and a lower rate of customer churn.

- Improved Agent Productivity: Agents are empowered with a powerful tool that allows them to be more effective, confident, and efficient in their support roles.

In an age where digital security and convenience are paramount, Samesurf cobrowse offers a powerful solution that helps financial institutions deliver on both fronts. It humanizes the digital experience, turning moments of friction into opportunities for trust and clarity. It’s time for banking to be as simple, secure, and supportive as it should be, and Samesurf cobrowse is leading the way.

Visit samesurf.com to learn more or go to https://www.samesurf.com/request-demo to request a demo today.